A lender must provide notice of default and intent to accelerate to a borrower before initiating foreclosure proceedings, and it is standard practice for lenders to include waivers of the notice requirement in the promissory note, the deed of trust, or both.

If the waiver provisions are not clear and unequivocal, however, they will be construed against the lender and the purported waiver will be invalid.

The history of one case in Texas, Mathis v. DCR Mortg. III Sub I, LLC, illustrates the potential consequences of poorly drafted loan documents and the failure to provide legal notice of default and intent to accelerate.

Although the borrower agreed to a waiver of notice in the promissory note, the deed of trust contained contradictory language that provided for notice of default and a time in which the default must be cured, ultimately resulting in a more than $800,000 judgment against the lender for wrongful foreclosure….

After several years of late payments and an unsuccessful attempt to sell the property, Mathis discovered that DCR mortgage intended to foreclose on his property.

Mathis preempted the foreclosure proceedings by filing a declaratory judgment action “requesting the court to ‘declare the status of, and the parties’ relative rights under’ the real estate lien note,” and seeking a temporary injunction to prevent DCR from going forward with a foreclosure sale, based in part on DCR’s failure to provide notice of default and their intent to accelerate the debt.

The trial court held that 1) DCR was entitled to foreclose, 2) Mathis had waived his right to notice in his loan documents, 3) DCR was entitled to attorneys fees, and 4) DCR was entitled to the funds Mathis had been depositing with the court pending suit.

The Texas Court of Appeals then reversed the trial court, finding that 1) DCR was required to give Mathis notice of intent to accelerate the debt and 2) the acceleration was improper because no notice was given.

The Court confirmed that waivers of notice can be valid, that it is “well settled that the maker may waive his right to notice of intent to accelerate and notice of acceleration,” and that waivers of notice can be effective if they are placed either in the promissory note or a deed of trust.

Waivers, however, must be clear and unequivocal and they must state “specifically and separately the rights surrendered.”

If there is a waiver provision in the note or the deed of trust, it must be consistent with the other documents that are executed in connection with the loan. If there is any doubt as to the meaning of the terms that are used, courts will interpret them in a way that avoids forfeiture:

The court then reiterated the general rule that, “[i]f a reasonable doubt exists as to the meaning of terms used in an acceleration clause, preference should be given to that construction which will avoid forfeiture and prevent acceleration of maturity.”

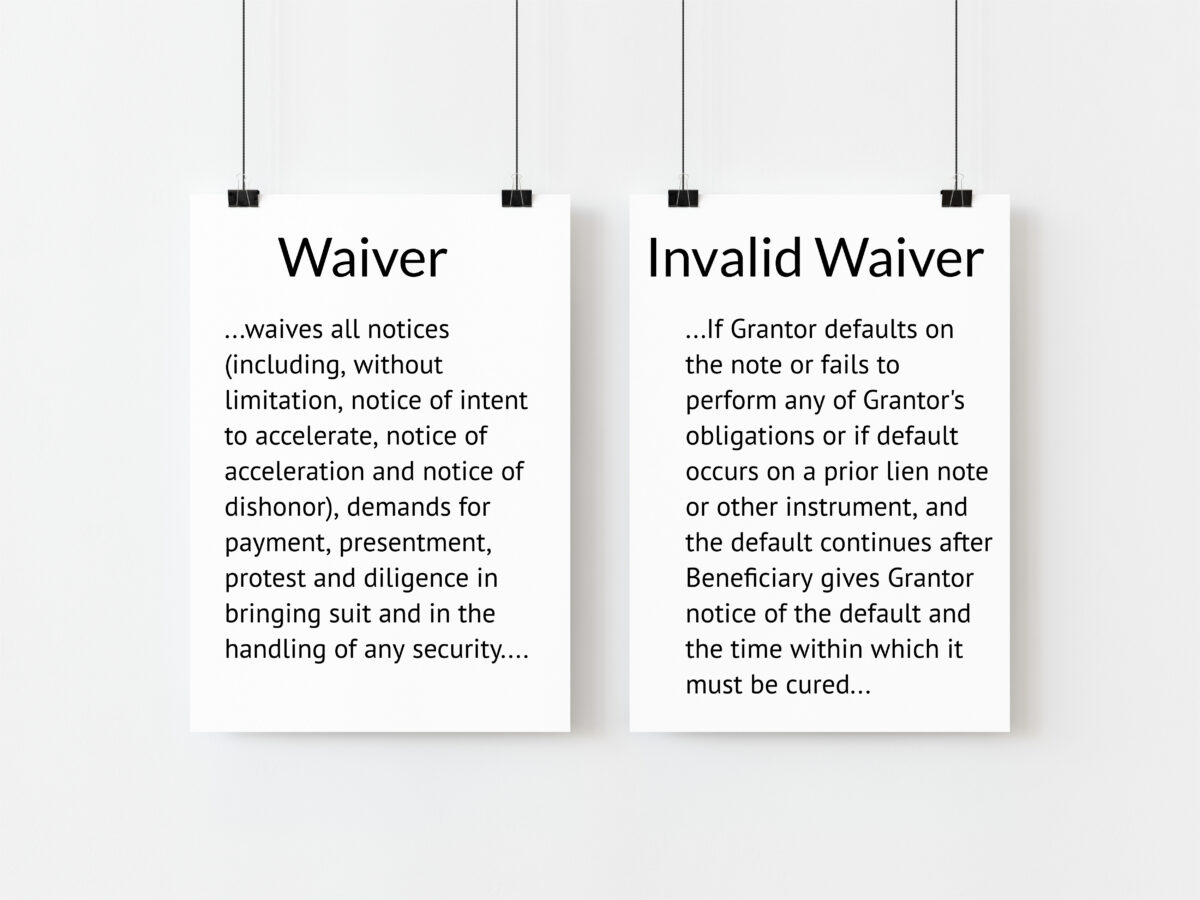

In Mathis v. DCR Mortgage, the note contained what would have otherwise been a valid waiver provision that stated:

Each of Makers, each guarantor of any of the Indebtedness, and each person who grants any lien or security interest to secure payment of any of the Indebtedness, (i) except as expressly provided herein, waives all notices (including, without limitation, notice of intent to accelerate, notice of acceleration and notice of dishonor), demands for payment, presentment, protest and diligence in bringing suit and in the handling of any security….

But the deed of trust contained language that contradicted the note’s waiver provision:

If Grantor defaults on the note or fails to perform any of Grantor’s obligations or if default occurs on a prior lien note or other instrument, and the default continues after Beneficiary gives Grantor notice of the default and the time within which it must be cured, as may be required by law or by written agreement, then Beneficiary may: a. declare the unpaid principal balance and earned interest on the note immediately due….

The Court found that “the note and the deed of trust must be construed together because:”

Finding that the contradictory language was ambiguous and should be construed in a way that avoids forfeiture, the Court held that the waiver provision was unenforceable. Because DCR did not provide notice of default and their intent to accelerate the debt, they did not have the right to foreclose on the property.

While the case was pending on appeal, DCR foreclosed on Mathis’ property, sold the property to itself for $500,000, and then relisted the property for $1,600,000.

When the Court of Appeals reversed the trial court, finding that DCR had no right to foreclose, Mathis filed another lawsuit against DCR alleging, among other things, wrongful foreclosure.

The trial court in the wrongful foreclosure action denied summary judgment, finding that there was more than sufficient evidence for a jury to find the elements of wrongful foreclosure, including:

The Court is clear that 1) a lienholder can rely on a judicial proceeding authorizing foreclosure, but 2) you don’t get immunity based on that judicial proceeding if the judgment is pending on appeal.

If you proceed with foreclosure proceedings before the time to appeal has passed or while the case is pending on appeal, you do so at your own risk…

At trial, the jury found that DCR’s foreclosure was wrongful, and Mathis was awarded damages in the amount of $716,947.06, $86,033.65 in prejudgment interest, post judgment interest, and costs.

Waivers of notice of default and acceleration are valid, but the loan documents must be consistent – you cannot have a waiver in the promissory note and a provision providing for notice in the deed of trust.

The bottom line is: 1) ensure that your loan documents are consistent before proceeding with foreclosure without providing notice, and 2) if there is any question about waivers of notice in the loan documents, send the notices.

Please feel free to contact one of our Murray Lobb Attorneys for advice on lending transactions, loan documentation, SBA loans, foreclosures, forbearances, modifications, bankruptcy and restructuring matters, disputes, consumer financial matters, and other banking-specific practices/needs.

We also remain available to help you with all your general business, corporate, and estate planning needs.