Need GST invoice formats in Word, Excel, PDF? Vyapar App simplifies invoicing, offers 200+ formats & tracks your business health. Download Now!

Download professional free GST tax invoice templates, and make customization according to your requirements at zero cost.

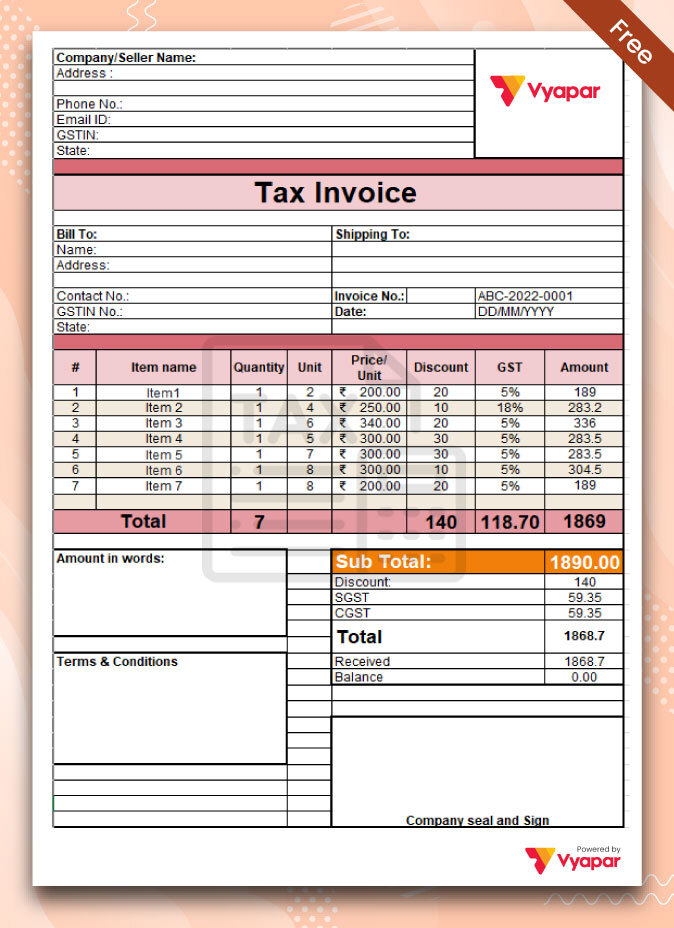

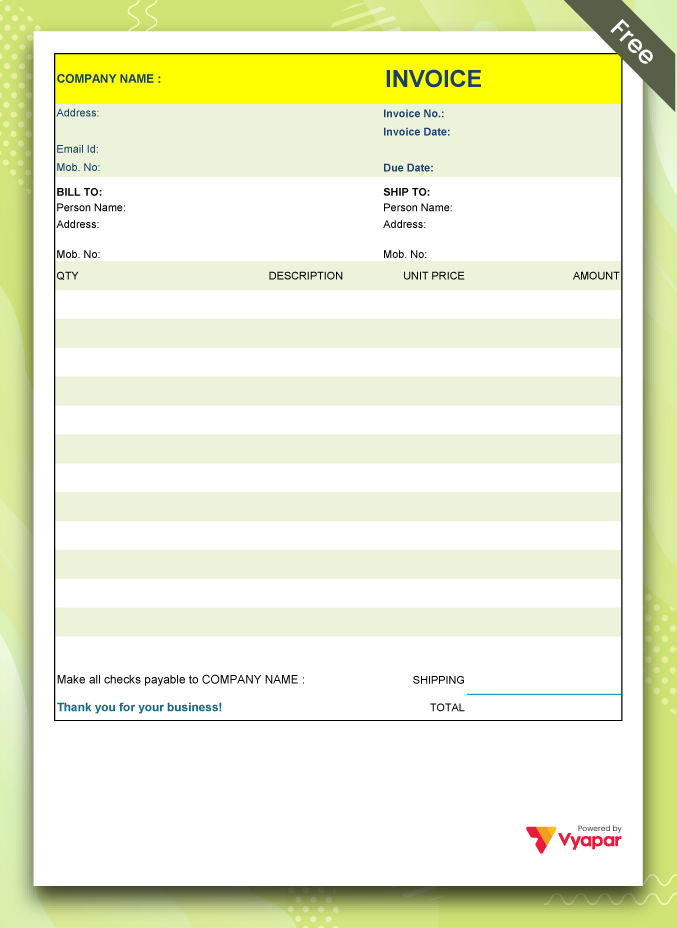

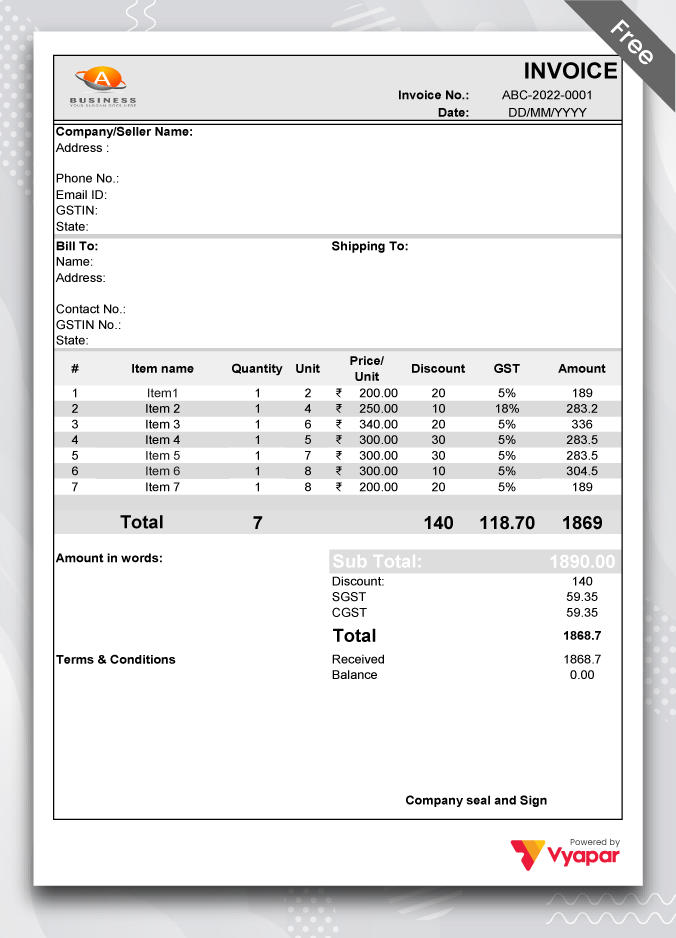

GST Bill Format – 01

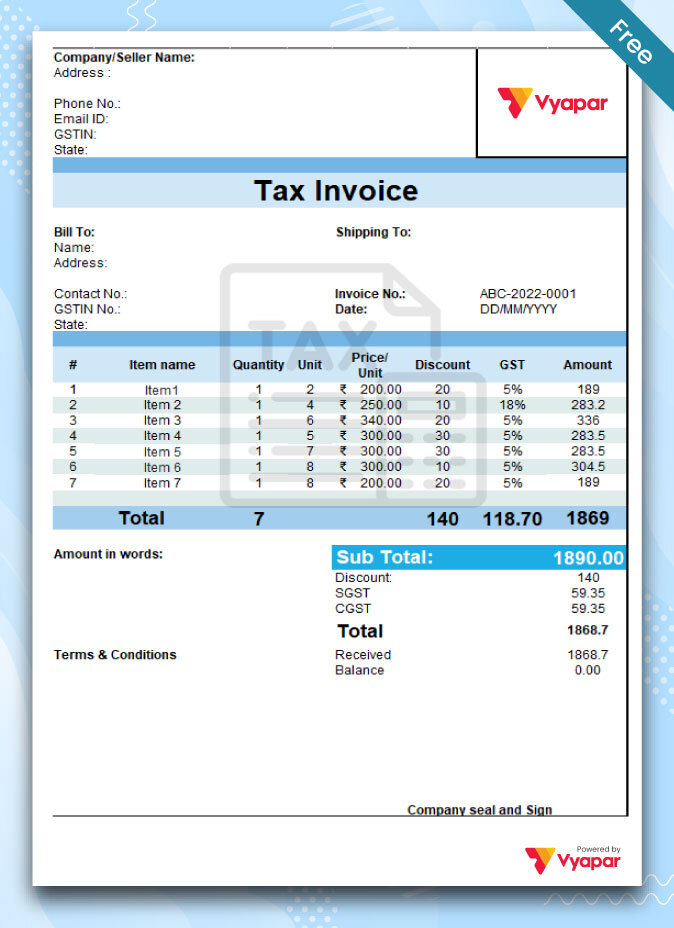

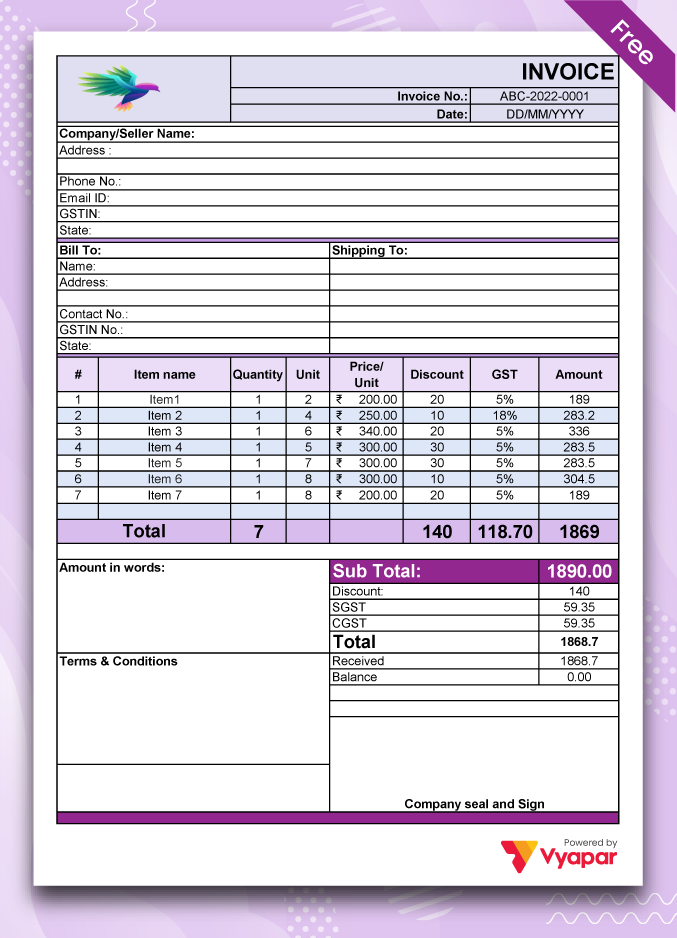

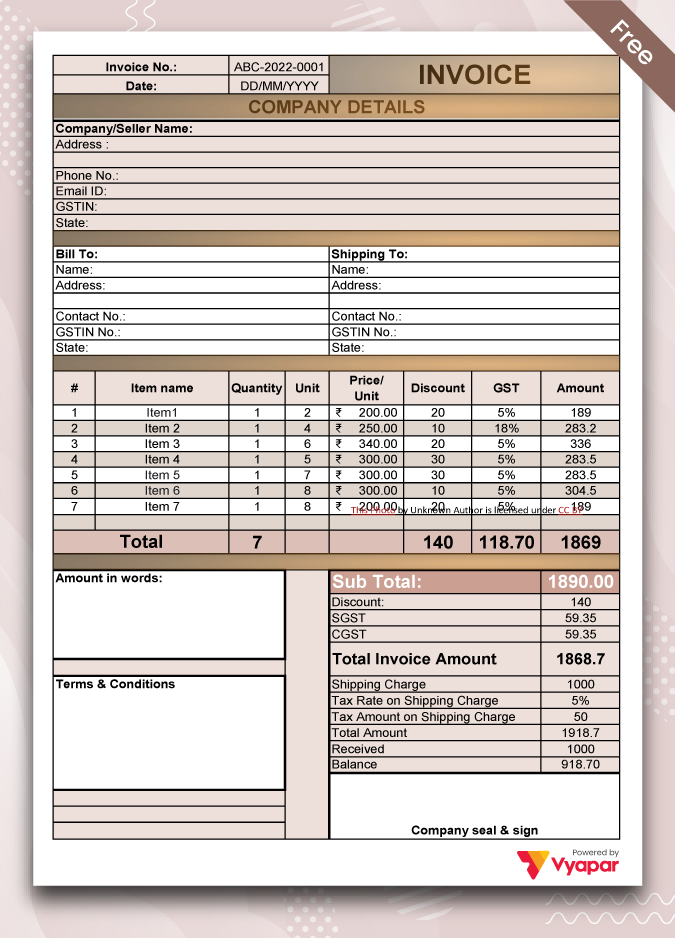

GST Bill Format – 02

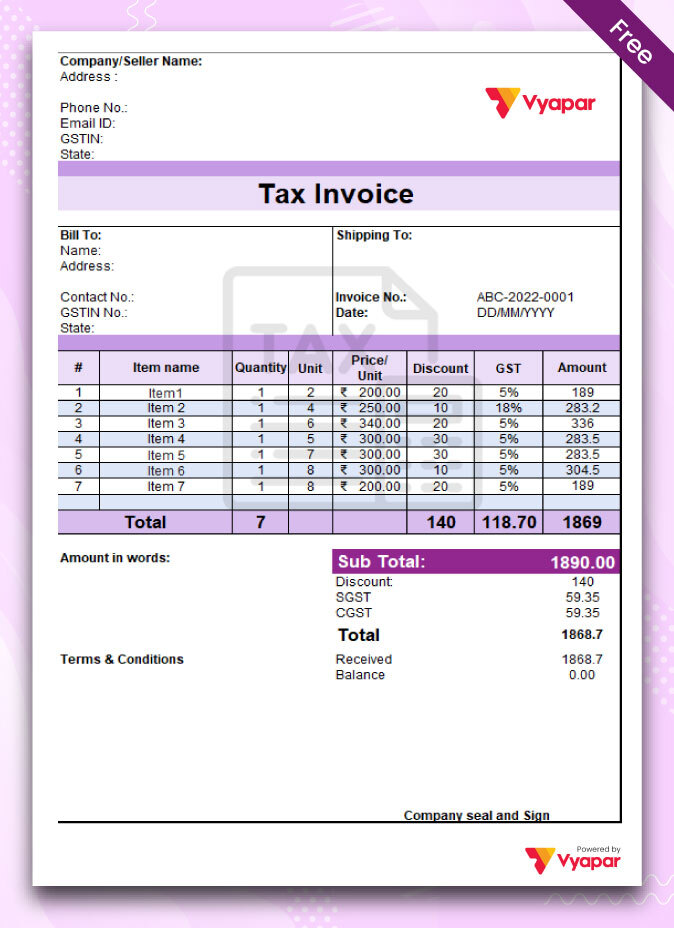

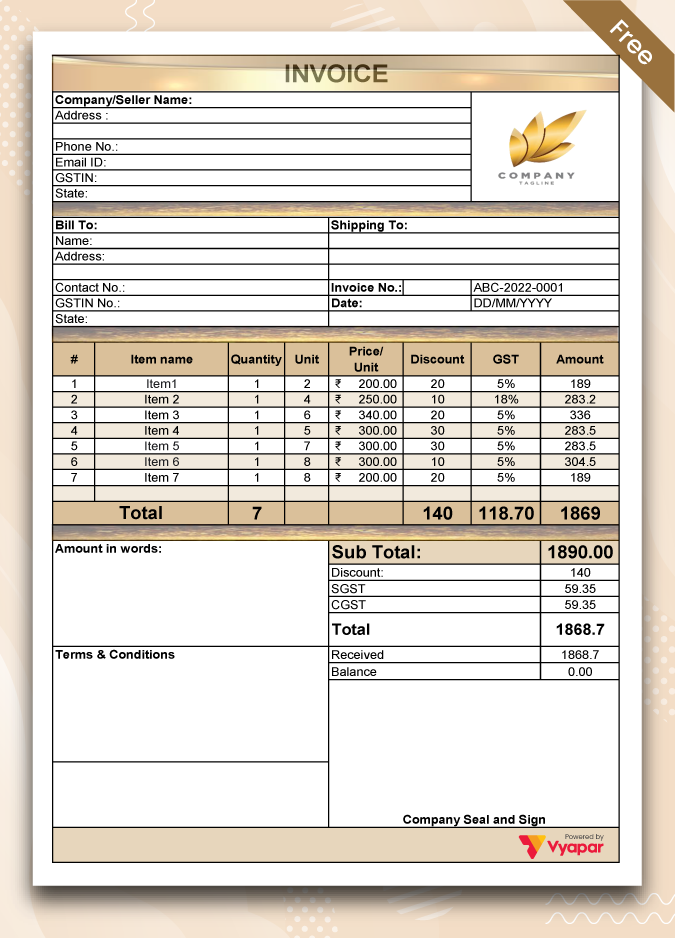

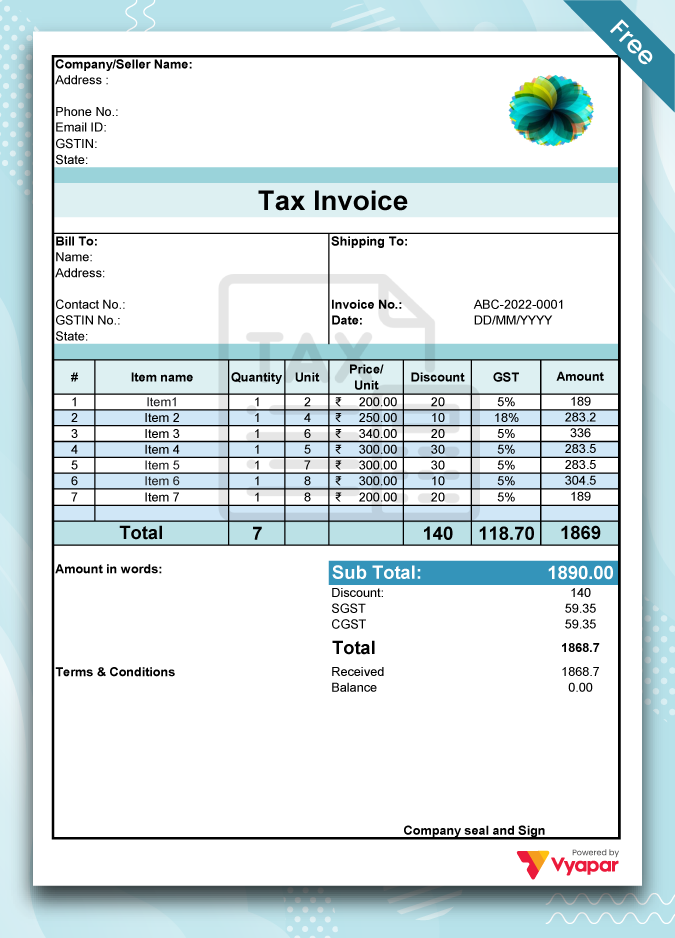

GST Bill Format – 03

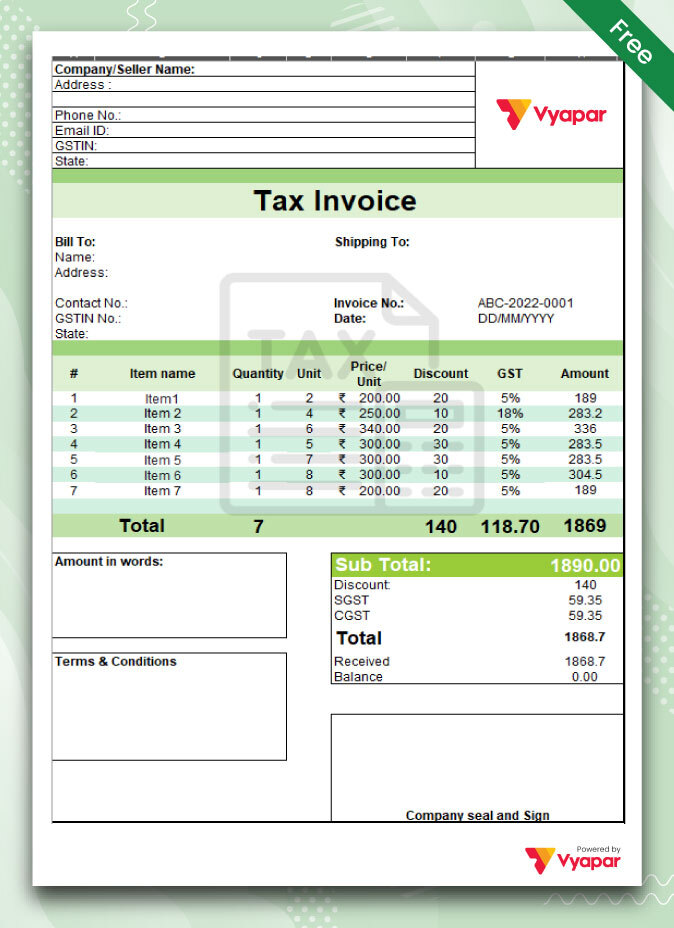

GST Bill Format – 04

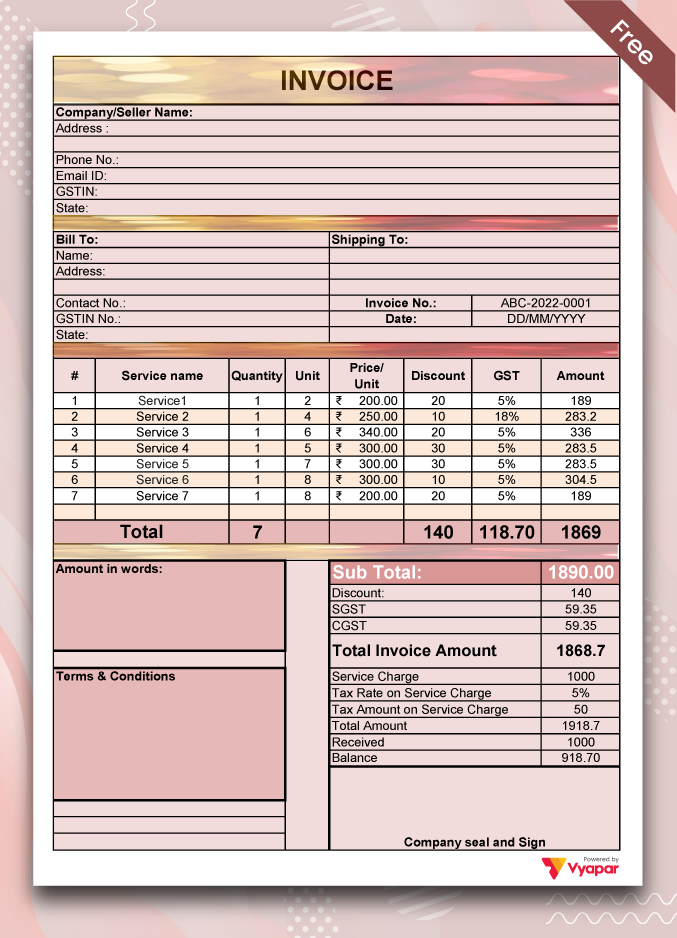

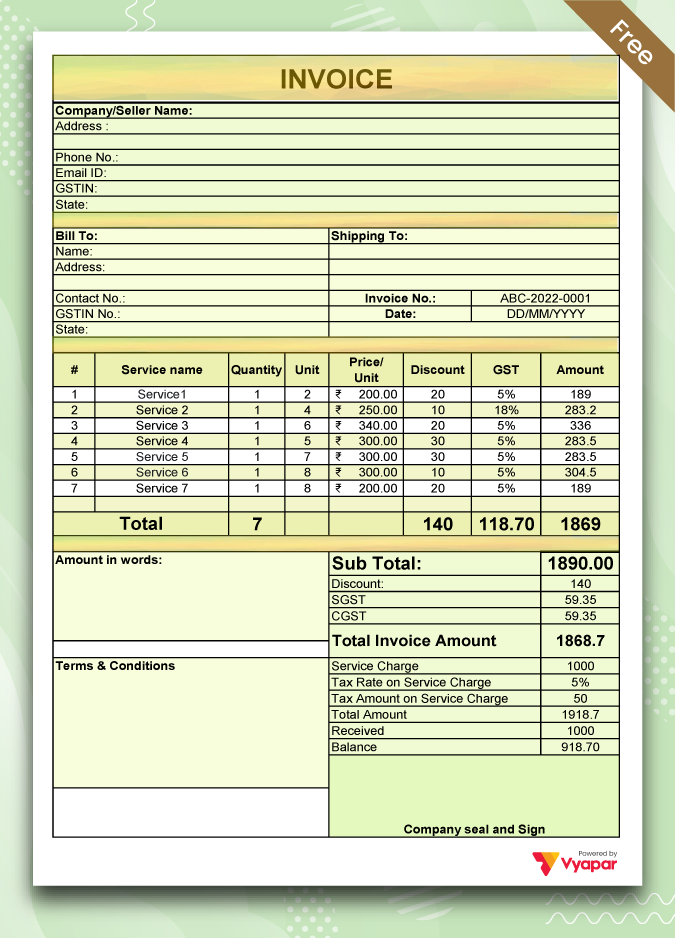

GST Invoice Format With Service Charges

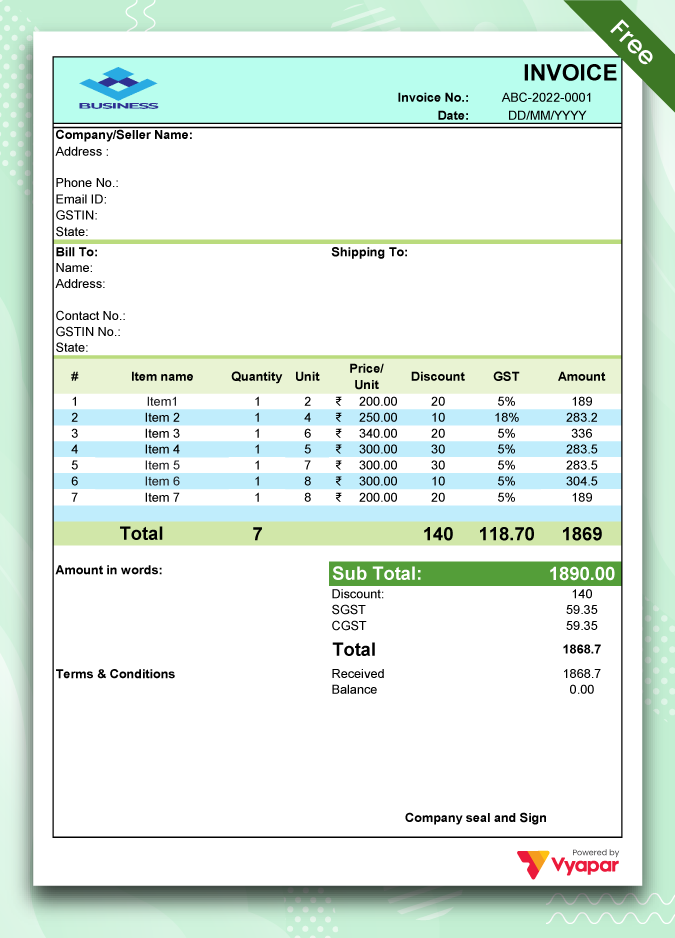

GST Invoice Format With Discount

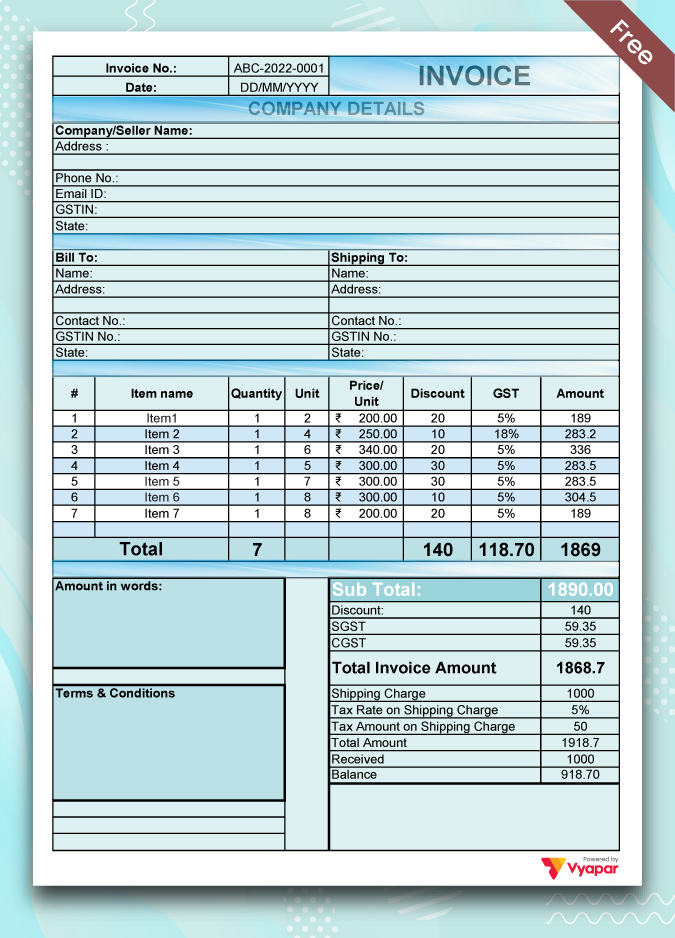

GST Bill Format With Shipping Charges

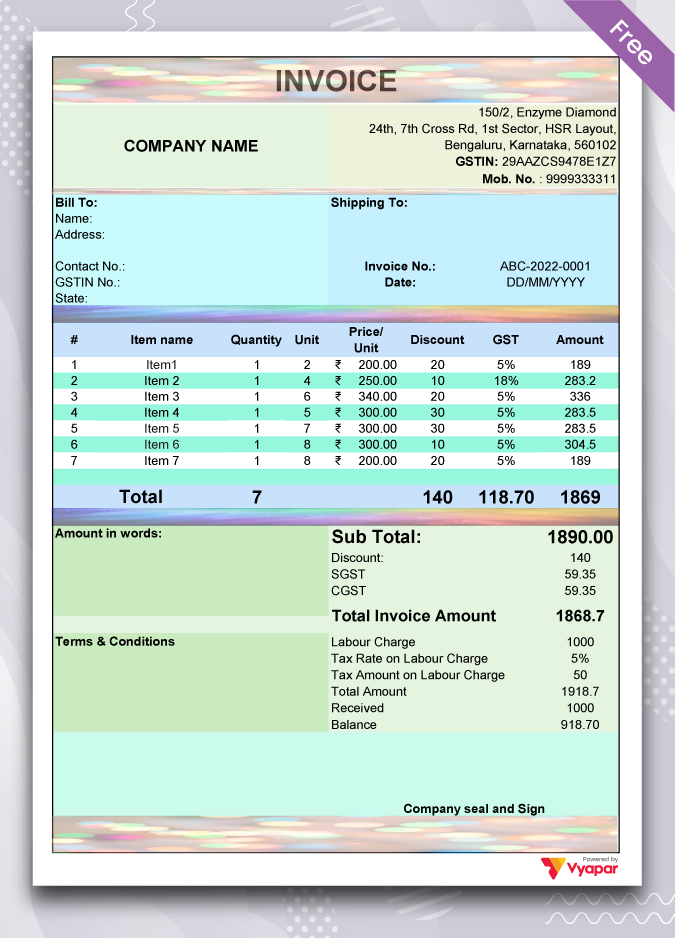

GST Invoice Format With Labour Charges

Without GST Bill Format

GST Bill Format – 05

GST Bill Format – 06

GST Bill Format – 07

GST Bill Format – 08

GST Bill Format – 09

GST Bill Format – 10

Overall, GST invoices are vital in ensuring transparency, proper tax collection and credit claiming processes within the Indian GST framework.

GST invoice format is a specific way to bill under the GST system of India. This ensures buyers have the information they need to claim tax credits. It includes details like supplier and recipient information, invoice number, product description, tax rates, and final amount. This format is mandatory for GST-registered businesses.

A tally GST invoice must reflect the details of all the goods and services the business supplies. It must have the company logo, details of the company and customer, invoice details, description of goods and services, taxes applicable, and signature of the authority.

With Vyapar, you can create tally GST invoices within minutes and export data from Vyapar to tally software. It helps you manage your accounts and handle the cash flow of business.

You can get payments on time without delay when you issue an invoice. Making invoices for your company is simpler with Vyapar’s Tally invoice format, which incorporates everything you need effortlessly.

B2C or business-to-consumer is a model in which goods or services move directly from a business to the end user. The consumer purchases products for personal use and not for reselling purposes.

B2C invoices are those invoices where the end user will not be claiming the input tax credit. Currently, B2C invoices are not mandated for electronic invoicing. To enable digital payments on B2C bills, a taxpayer needs to create a dynamic QR code, as per Notification No.

A document known as an export invoice lists the products or services that an exporter provides together with the importer’s payment obligations. With a few extra details, the format is rather resemblant to a standard tax invoice.

Exports of goods or services are now governed by the IGST Act and are classified as interstate supplies under the GST Law. Exports of products or services that qualify as “zero rated supplies” are exempt from GST assessed at either the input or final product stage.

The non-GST invoice is issued for the supply of goods and services which are not covered under the ambit of GST. There are no rules and mandatory fields in non-GST invoice format. Any unregistered person not liable to register under GST can issue a bill of supply.

It is effortless to make the non-GST invoice. You can prepare the invoice in word, excel, or doc format. Vyapar has a variety of templates available, and you can choose any template and make necessary changes per your requirements.

You can customize your invoice, which makes it look professional. The saved templates save you time and let you generate bills at any time.

A special economic zone (SEZ) is a unique region with different economic rules from the other areas in the same nation. The businesses in SEZ enjoy tax benefits and fewer legal compliances. Although SEZ is found within a country’s national border, it is considered a foreign territory for tax purposes.

A supply of goods or services to anyone by SEZ is considered an interstate supply, and IGST is payable for such supply. Any goods, services, or both supplied to a developer or unit within a Special Economic Zone shall be regarded as zero-rated. So, under GST, it is a zero-rated supply.

As a result, suppliers that provide goods to SEZs have two options:

The composition system is a different way to impose a tax under the GST. The composition plan is available to any taxpayer whose annual revenue was less than Rs 1.5 crore in the last fiscal year.

Small dealers and enterprises can pay GST at a predetermined turnover rate and submit quarterly GST reports under the GST Composition Scheme. Thus, the composition scheme lessens the compliance work of small taxpayers and makes the whole process affordable.

The composition dealer must issue the Bill of Supply instead of a tax invoice when opting for the composition scheme. There is no concern about claiming the Input Tax Credit because the composition dealer will not be the one to issue the tax invoice.

Under the GST Act, renting out immovable property is treated as a supply of services. However, the GST is applicable only on certain types of rent, which include:

When the landlord gives property on lease, rent, easement, or licensed to occupy Leases (or rentals) of commercial, industrial, or residential properties for business (partially or fully)

This renting is considered a supply of services and would thus attract tax. GST is not applicable when renting residential property for residential purposes. Any lease or renting of the real estate for business purposes would be subject to GST at 18% because it is a supply.

The supplier is required to include GSTIN and a unique serial number in the tax invoice. Hence, businesses should adopt an invoice numbering system compliant with GST regulations, and GST invoices must include certain essential details.

These details typically comprise the invoice date, names and addresses of the sender and recipient, descriptions of the goods, quantities, total supply values, taxable supply values, tax rates, amounts, and final values, which are consistent across all invoice formats.

Our app offers various templates, including Word, Excel, and Doc formats. With Vyapar invoicing software, you can effortlessly convert your invoice into PDF format.

As a GST-registered merchant, it’s essential to issue GST invoices, also known as GST bills, to your customers. To comply with GST regulations, businesses must implement an invoice numbering system and include GSTIN along with a unique serial number on the tax invoice.

Every invoice must include the invoice date, sender and recipient details, item descriptions, quantities, total supply values, taxable supply values, tax rates, amounts, and final values.

An invoice or GST bill typically contains a list of supplied products or services rendered, along with the payment amount due. With Vyapar Software, you can effortlessly generate GST-compliant invoices at no cost.

Since transfers are included in the definition of a “supply” under the GST, branches must be recognized as separate companies. Therefore, any stock transactions in the following two scenarios are taxable:

Intrastate stock transfer: Only when an entity has more than one registration in a state Interstate stock transfer: Transfers between two entities with different state addresses are taxed.

Cash flow will be impacted by whether stock transfers are subject to GST taxation. It is because tax is paid on the date of stock transfer, and ITC is effectively used when the receiving branch liquidates stock.

An export document known as a commercial invoice is used to prove a sale transaction between the buyer and the seller in court. It helps determine and assess the number of duties and taxes that must be paid and is mainly used for customs clearance reasons.

It includes a detailed list of the items sold, their quantities, and their agreed-upon prices. An “invoice” or “tax invoice” under the GST regime refers to the tax invoice described in section 31 of the CGST Act, 2017. According to this section, a supplier must issue an invoice for the supply of goods or services.

With GST, it has become easy for suppliers to calculate taxes. Octroi, central sales tax, and other indirect taxes are subsumed under GST, reducing manufacturers’ burden. Before the application of GST, manufacturers had to pay 25% extra production cost, but now the cost is reduced.

As per GST regulations, the tax rate is 18% if manufacturing services are done on items owned by unregistered persons. When a principal manufacturer sends goods for further processing to a job worker, they can claim an input tax credit of tax paid on the purchase of such goods sent on job work. However, an invoice is required to avail ITC.

ITC will be allowed when goods are sent to job workers:

Any services provided regarding the planning, promotion, organization, and presentation of any arts, entertainment, business, sports, wedding, or other events can be classified as Event Management.

When preparing an invoice for an event, you must add your company logo, name, and contact details. Outline the specifics of all the services you provided and the amount you charged. Add all the materials, props, or equipment you used to prepare for the event.

It might be challenging to add everything to the invoice manually. Our invoicing app is here to help. We have various templates available that let you customize your invoice. All the fields are mentioned beforehand; you need to edit them per your requirements.

Any supplier of services whose aggregate turnover exceeds the threshold limit of Rs 20 lakhs is liable to get registered under GST. However, the threshold for the special category states is as low as 10 lakh INR. The supplier must issue a GST invoice at the time of supply of services.

Time of supply of services is earliest of:

The GST margin policy helps prevent double taxation on the supply of items that have already been subject to tax. Suppliers or sellers of goods can calculate the margin between the value of goods supplied by the seller and the value of goods received by the customer under the Margin Scheme, GST.

However, individuals dealing in such goods may be eligible to pay tax solely on the margin for pre-owned products. Generally, GST is levied based on the actual transaction value of the items delivered, as per valuation regulations. If there are no margins, no GST would be applicable to the transaction, and the GST margin scheme operates on this principle.

A GST invoice is generated whenever a registered taxable person provides taxable goods or services. An invoice that complies with GST must be issued and received to be eligible for an ITC.

If a taxpayer fails to provide such an invoice to a registered taxable customer, the customer forfeits the right to claim the ITC, and the taxpayer loses those clients.

Depending on the nature of the supply, the tax is paid. CGST+SGST must be paid as tax if the supply is an intra-state supply, and IGST must be paid as tax if the supply is an inter-state supply.

As per the GST laws, the services provided by a hotel are taxable. The place of supply remains the hotel’s location, regardless of whether the guest is registered in another state. The GST rate on hotel accommodation services is 18%, although it can be 12% per the hotel’s room tariff.

The hospitality industry stands to gain from standardized and consistent tax rates as well as simple and improved input tax credit use under the Goods and Service Tax. The sector draws more foreign tourists as the end customer’s overall cost declines.

Hotels that are users of Vyapar can create a GST-compliant invoice in a few simple steps. Choose any format from the available hotel bill templates, edit your customer’s details, make necessary changes, and your invoice is ready.

A pure agent is someone who, while making a supply to the recipient, also obtains and purchases another supply on the recipient’s behalf. Then they seek compensation (as actual, without increasing the worth of his supply) for those other supplies from the primary supply recipient.

If all requirements are met, the expense or expenses incurred by the service provider acting solely as an agent of the service recipient are not included in the value of the taxable service. However, if the conditions are not satisfied, the invoice shall include such expenses in the supply value under GST.

The repayment of money spent by an individual is referred to as reimbursement of expenses. It occurs in business transactions when a supplier incurs expenses on behalf of the recipient who is obliged to bear such expenses.

Two types of expenses may get reimbursed to the supplier under GST:

The supplier is unable to levy GST on the reimbursement amount for expenses as it is not part of the supply value. They can only charge the actual amount disbursed to the recipient.

A reverse charge would be applicable if a seller who is not registered supplied goods to a registered person. As a result, the government receives the GST directly from the recipient rather than the supplier. For Inter-state purchases, the buyer has to pay IGST.

You must self-invoice when you buy products or services from an unregistered provider, and the transaction qualifies for reverse charge. It is because your supplier cannot send you a GST-compliant invoice, and as a result, you are responsible for paying taxes on their behalf. As a result, self-invoicing is required in this scenario.

You can provide goods or services to SEZ by paying IGST. In this situation, a clear statement that reads “Supply meant for SEZ with payment of integrated tax” must be present on the supplier’s invoice. According to section 16(3) of the IGST Act, suppliers who cannot employ LUT for whatever reason may choose to charge IGST instead.

Any supply of products, services, or both to a developer or unit within a Special Economic Zone shall be regarded as zero-rated. Therefore, these goods and services are GST-free.

Except for services provided by GTA and courier services, all road transportation services are GST-exempt. Any person who offers a consignment note for the delivery of goods will be considered a GTA.

The 5% GST rate that applies to GTA’s transportation services provided on an RCM basis means that the recipient must pay the tax, and the transporter cannot claim an ITC. GST rate of 12% on a forward charge basis (ITC is available to transporters).

According to GST law, any registered person who purchases goods or services from an unregistered party must submit a payment voucher and a tax invoice. The category of the registered person making the supply determines the sort of invoice that needs to be provided.

In cases when the supplier is not registered, the consumer creates a self-invoice format under GST. Usually, a provider is responsible for paying the tax on supplies, but with the reverse charge mechanism, chargeability is switched.

The person who receives the goods and services is now responsible for paying the tax. The reverse charge mechanism only applies to specific kinds of business entities. The purpose of shifting GST payments to recipients is to increase tax levies on various unorganized sectors.

If your company is GST-registered, you must issue GST-compliant invoices to customers to sell products, services, or both. A tax invoice is typically provided to charge the tax and transfer the input tax credit. The following required fields must be present on a GST invoice:

Any supplier of goods whose aggregate turnover exceeds the threshold limit of Rs 40 lakhs is liable to get registered under GST. However, the threshold is as low as 10 lakh INR for the hill and northeastern states. The supplier needs to issue a GST invoice at the time of supply of goods.

The earlier of the following dates shall be the time of supply of the goods,

When consumers purchase gold in India, they are charged a GST of 3% by the seller. GST making charges amount to 5% of the price of the making charges. A 10% import duty may also be charged to sellers importing gold abroad.

It might be challenging for a jeweller to keep track of the accounts. With our fantastic collection of invoice templates, you may save time and effort with some assistance with the administrative aspect of running a jewellery business.

These beautiful invoices, accessible in Word, Excel, PDF, Google Docs, and Google Sheets, will help you save time so you can return to making gorgeous jewellery items rather than concentrating on your invoicing.

Invoices are generally the only evidence of a transaction made between a customer and seller to purchase and sell goods or services. The seller uses these documents to collect assured payments from the buyer as and when it was promised. Thus, an invoice needs to have details like the goods or services that were sold, the quantity of the sold goods or services, price, due payment, tax details, and other terms and conditions, if any. Issuing invoices is not just recommended but also mandated by GST law for taxpayers when making a sale. Without GST, this process does not aid the seller in collecting payment.

Taxpayers issue various types of invoices based on factors like the nature of goods/services, discussed terms, and business size. Invoices play a crucial role in daily operations, such as recording sales, preventing fraud, and collecting input credit. Therefore, understanding the invoice format is essential for generating accurate invoices and ensuring smooth business transactions. Vyapar provides GST formats in Word and Excel to help you with this process.

Using an Invoice Template PDF is the simplest method to send a visually appealing and organized invoice to clients. Simply download the GST format, customize it with your company and client details, and then either email or print the invoice to your customer in PDF format. However, PDF invoices can be challenging to edit if necessary. Explore alternative options for such scenarios.

Invoice format in Excel is popular to be used for structured data in tabular form, especially invoices. It avoids the mess that seems unattractive in a PDF or Word form. It also supports multiple formulas that make it easier for you to perform calculations when you prepare the invoice itself. In other cases, you would generally need to perform the calculations yourself.

Some don’t use Excel or PDF invoice formats since they prefer using an online invoice generator instead. There, you will have all the features of Excel, Word, and PDF invoice formats included.

The most crucial aspect of a GST tax invoice format is the accuracy and precision of the details entered for the customer’s attention. These details should be clear and concise for easy readability.

You should enter the following details in a GST bill format pdf, excel, word:

All the details mentioned above are very important, and hence you need to add them to a GST Tax invoice format before forwarding it to your Customer. Without GST Invoice format you cannot forward to your customer.

Under the GST regime, a registered taxpayer is responsible for issuing GST invoices.

It generally applies to businesses that supply goods or services. An invoice needs to be issued to another registered taxpayer for the supply of goods or services.

There are some exceptions to this:

A GST invoice must contain specific details to be considered valid and enable appropriate tax credit claims. Here are the major components of a GST invoice:

Remember, these are the key components and specific formats or additional information may be required depending on the type of transaction or government regulations.

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

In case you’ve supplied goods to your Customer, you’ll need to issue a GST Tax Invoice on the same date or even before the day of delivery of those goods. Whereas, if you’ve delivered services, you have 30 days to issue a GST Tax Invoice to your customers.

You can create a free simple GST bill format in Excel very easily using the steps below:

Step 1: Go to Microsoft Excel

When you go to Microsoft Excel, click on the “file” option, and then click “new.” Then, you’ll need to double click the ‘blank workbook’ to be able to open a new excel sheet.

Step 2: Remove Gridlines.

Simply click the ‘view’ tab, and uncheck the ‘gridlines’ column.

Step 3: Add the company Logo and other Details

Now, to make this excel sheet belong to your company, add your company’s logo and other important details such as name, address, contact details, etc.

Step 4: Add customer details

You only need to perform this step once since Excel will remember the customer details the next time. So, edit the sheet and add customer details

Step 5: Enter the Transaction Details

Now, add the transaction details wherein you describe the goods/services that were sold with their price, quantity, total amount, etc. This way, the Customer won’t have to look into his records to confirm the transactions that were made.

Step 6: Provide Payment Details

Add your Bank details with your preferred payment option and due date so that the ultimate purpose of the invoice can be served.

Now, your GST invoice format in Excel downloads very well and is a professional format for your device.

Create a free GST invoice format in PDF, you need to use a few steps involved in Word or Excel format. Use the following steps to do so:

Step 1- Go to Microsoft Excel/Word

As told earlier, you’ll need Word or Excel to create a GST invoice format PDF.

Step 2 – Edit Columns, Tables, etc.

Insert tables like you did in Excel or Word and adjust it according to the requirements of the invoice.

Step 3 – Enter Company Details

Now, enter the company’s name, address, ZIP code, and email address of the company to the invoice.

Step 4 – Add company logo

By adding the company Logo, the invoice looks more professional and is received well by the Customer.

Step 5 – Enter Customer Details

Add Customer’s name, phone number, email address, company address, and ZIP code to the invoice.

Step 6 – Enter transaction details and bank details

Enter the transaction details and your bank account number, IFSC code, etc. to the invoice.

Step 7 – Select ‘File’ and then choose ‘download’

Choose the file from the main menu, and then click download from the drop-down menu that appears.

Step 8 – Click on ‘PDF Document’

Select ‘PDF document’ from the menu that appears on the screen.

Your invoice is now downloaded in PDF format on your device.

GST Invoice Format in Word?In the same way that you created a GST bill format in Word, PDF and Microsoft Excel, you can do it in Microsoft Word as well. You need to follow the steps below:

Step I: Go to Microsoft Word

You will need to go to Microsoft Word to create a blank word document.

Step II: Insert Tables

The next step would be to insert tables by simply clicking on the ‘insert’ tab, and then clicking on’table.’ You’re free to change the number of rows and columns as per your invoice requirements.

Step III: Edit Columns

If your columns have extra space other than the entered details, it will look messy and unattractive. So, adjust their size as per the details you need to mention

Step IV: Enter Important Details

Start with entering your company details, including its name, address, contact details, zip code, etc. Then, enter the invoice date, payment due date, order numbers, date of purchase, etc. Mostimportantly, enter your customer details wherein you mention the transaction details, the quantity of goods/services sold, applicable GST tax, etc. Remember that you must keep the calculations in handy since the word doesn’t allow you to use formulas. Add your bank details too.

Step V: Save the Word document

The GST (Goods and Services Tax) invoice format includes the following key elements:

1. Invoice Number: A unique identifier for the invoice.

2. Invoice Date: The date when the invoice is issued.

3. Supplier Details: Name, address, GSTIN (GST Identification Number), and state code of the supplier.

4. Recipient Details: Name, address, GSTIN, and state code of the recipient.

5. Description of Goods/Services: Details of the items sold or services provided, including quantity, unit price, total amount, and applicable taxes (CGST, SGST, IGST).

6. HSN (Harmonized System of Nomenclature) Code: For goods, HSN codes are required for proper classification.

7. Taxable Value: Total value of goods/services before applying taxes.

8. Tax Amount: Breakdown of CGST, SGST, IGST, and any other applicable taxes.

9. Total Amount: Final amount payable, including taxes.

10. Payment Terms: Terms of payment such as due date, payment mode, etc.

11. Signature: Signed by the supplier or authorized person.

The GST (Goods and Services Tax) on an invoice is paid by the end consumer or customer who purchases goods or services. Businesses collect GST from their customers on behalf of the government and then remit it to the tax authorities. The GST amount collected is based on the GST rates applicable to the specific goods or services sold.

You can issue invoices without GST in certain situations:

1. Exempt Supplies: If your business deals with exempt supplies, you don’t need to charge GST on those invoices.

2. Reverse Charge Mechanism (RCM): In RCM cases, the recipient pays GST, so you can issue invoices without GST.

3. Composition Scheme: If you’re under the composition scheme, issue a bill of supply without GST.

4. Interstate Supply to Unregistered Persons: For interstate supplies to unregistered persons under Rs. 50,000 annually, no GST on invoices is required.

The limit for a GST invoice depends on the type of business and transaction. There is no specific limit for regular businesses, but those under the composition scheme issue a bill of supply. Additionally, invoices without GST can be issued for interstate supplies to unregistered persons below Rs. 50,000 annually.